In the digital era, the business world is evolving rapidly, and business valuation is among the fields undergoing significant transformation. With increasing globalization and growing corporate complexity, traditional valuation methods are no longer sufficient. In this article, Sapio Insights examines the future of business valuation and the key trends shaping the field. From the rising use of artificial intelligence and machine learning to the growing importance of ESG factors, new developments are redefining how we assess business value. This article explores what lies ahead for this critical area of finance.

1. Current State of Business Valuationn

Business valuation is an indispensable part of the financial industry. It serves to determine the value of a company for a variety of purposes, including mergers and acquisitions, tax planning, and litigation. Traditional valuation methods—such as the discounted cash flow (DCF) approach and the market approach—have been widely applied for decades. However, as businesses grow increasingly complex and economies become more globalized, these methods are proving less adequate in capturing the full picture of corporate value.

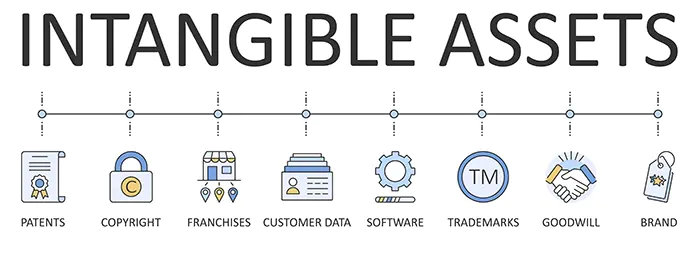

In recent years, the market has shifted toward more sophisticated valuation methods that take a wider range of factors into account. These include intangible assets such as intellectual property and brand value, as well as environmental, social, and governance (ESG) considerations. As companies seek to more accurately reflect their true worth in a rapidly changing economic landscape, the adoption of these new approaches is becoming increasingly common.

With the continued rise in mergers and acquisitions, business valuation has grown in importance. In such transactions, accurate valuations are essential to ensuring that both parties achieve a fair deal. As a result, demand for skilled business valuation professionals is on the rise.

2. The Impact of Technology on Business Valuation

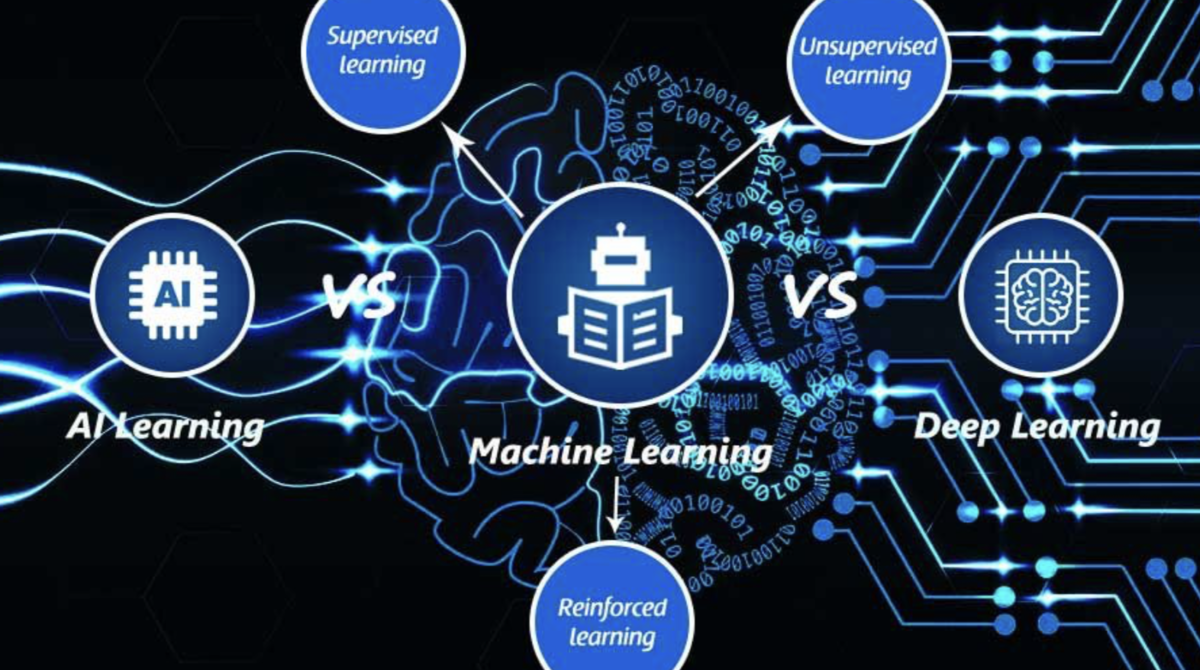

Technology is exerting a profound influence on the field of business valuation. Artificial intelligence and machine learning algorithms are being employed to analyze vast datasets and uncover patterns that would be difficult for humans to detect. These technologies are particularly effective in assessing companies with complex data structures, such as those in the technology sector.

Another way technology is shaping valuation practices is through the development of online valuation tools. These platforms enable businesses to quickly and easily estimate their value based on a range of factors, including financial performance, industry trends, and market conditions. While such tools may not provide the precision of a professional valuation, they can serve as a useful starting point for companies seeking a preliminary understanding of their worth.

3. Emerging Trends in Business Valuation

One of the most significant trends in business valuation is the growing reliance on technology. Artificial intelligence and machine learning are increasingly used to analyze large volumes of data, identify hidden patterns, and provide insights that enable a deeper understanding of complex businesses.

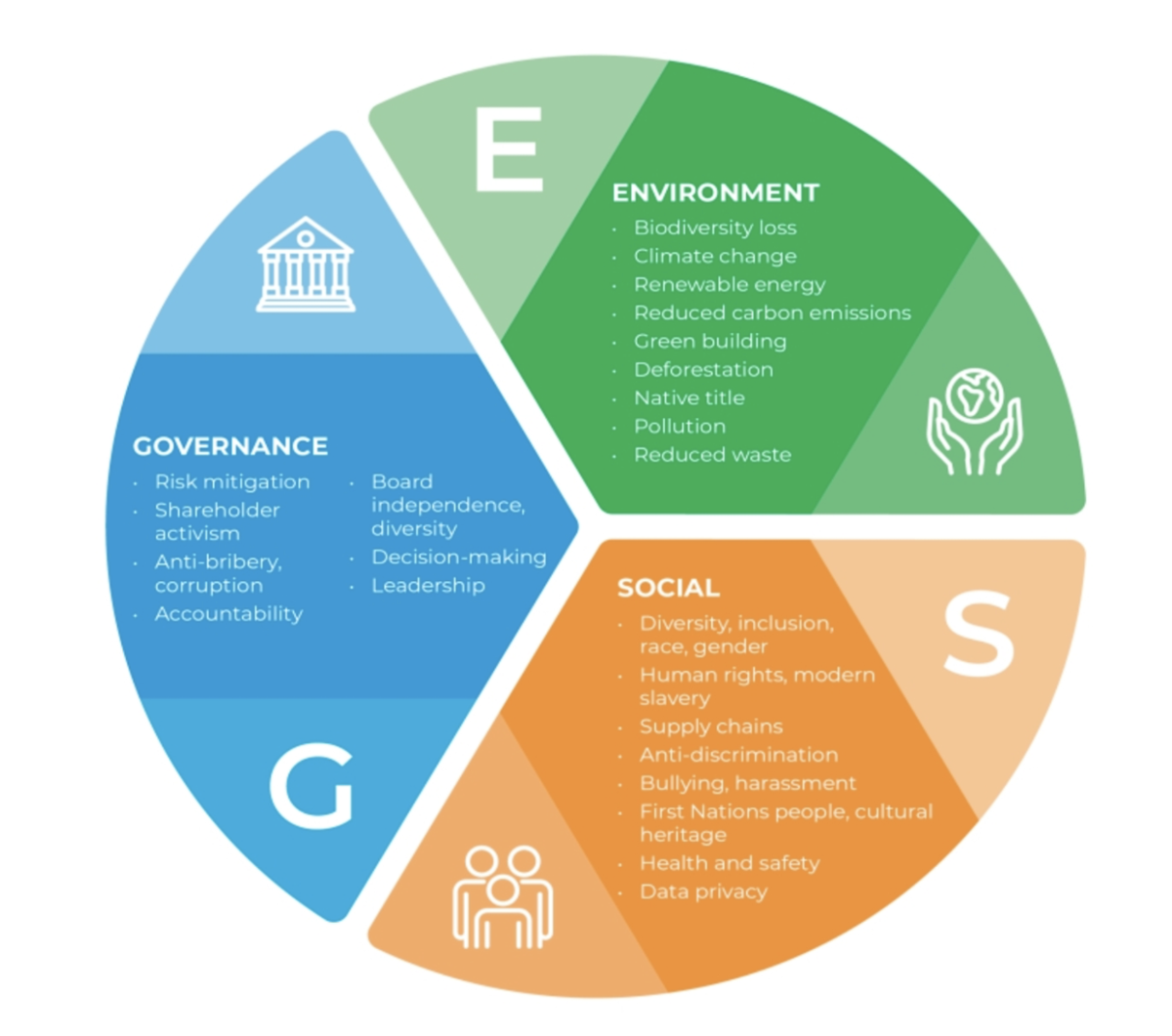

Another major trend in business valuation is the rise of ESG factors. These encompass a company’s environmental impact, social responsibility, and governance practices. Investors are showing increasing interest in companies that prioritize ESG performance, making these considerations an increasingly important component of corporate valuation.

The growing emphasis on intangible assets such as intellectual property and brand value is another notable trend. In the past, these assets were often undervalued or overlooked in business valuations. However, as companies become increasingly reliant on them, their significance in determining corporate value has grown substantially.

4. The Importance of Accurate Business Valuation

Accurate business valuation is critical for a wide range of purposes, including mergers and acquisitions, tax planning, and litigation. Inaccurate valuations can lead to serious consequences—such as undervaluing a company during a merger or acquisition, or overpaying in taxes.

Accurate valuation is also vital for businesses seeking funding or investment. Investors and lenders expect valuations that genuinely reflect a company’s worth. An inaccurate assessment can result in limited access to capital or investment, which in turn may hinder a company’s growth and long-term success.

5. The Role of Business Valuation in Mergers and Acquisitions

Business valuation plays a pivotal role in mergers and acquisitions. Accurate valuations are essential to ensuring that both parties achieve a fair deal. Misvaluation can result in one side being overvalued or undervalued, creating serious consequences for both.

Valuation is also central to determining the structure of a transaction. For example, it can guide the allocation of cash versus stock in a deal, and influence the extent to which debt is used to finance the transaction.

6. The Future of Business Valuation

Business valuation is poised to be a rapidly evolving field. As companies grow more complex and economies become increasingly globalized, traditional valuation methods are no longer sufficient. The rising use of technology, the increasing importance of ESG considerations, and the growing focus on intangible assets are just some of the trends reshaping the business valuation landscape.

Accurate valuation remains critical for a wide range of business purposes, and companies should take the necessary steps to ensure they are well-prepared. By engaging the right industry experts and staying informed of the latest trends and technologies, businesses can ensure that their true value is accurately assessed.