In a landmark move reflecting his enduring business foresight, Li Ka-shing, Hong Kong’s most prominent entrepreneur, has orchestrated a $19 billion transaction to divest the majority of CK Hutchison Holdings Ltd.'s global port assets. This sale to a BlackRock Inc.-led consortium marks a pivotal shift for the conglomerate, signaling a strategic recalibration in response to evolving geopolitical and market dynamics.

Navigating Geopolitical Complexities

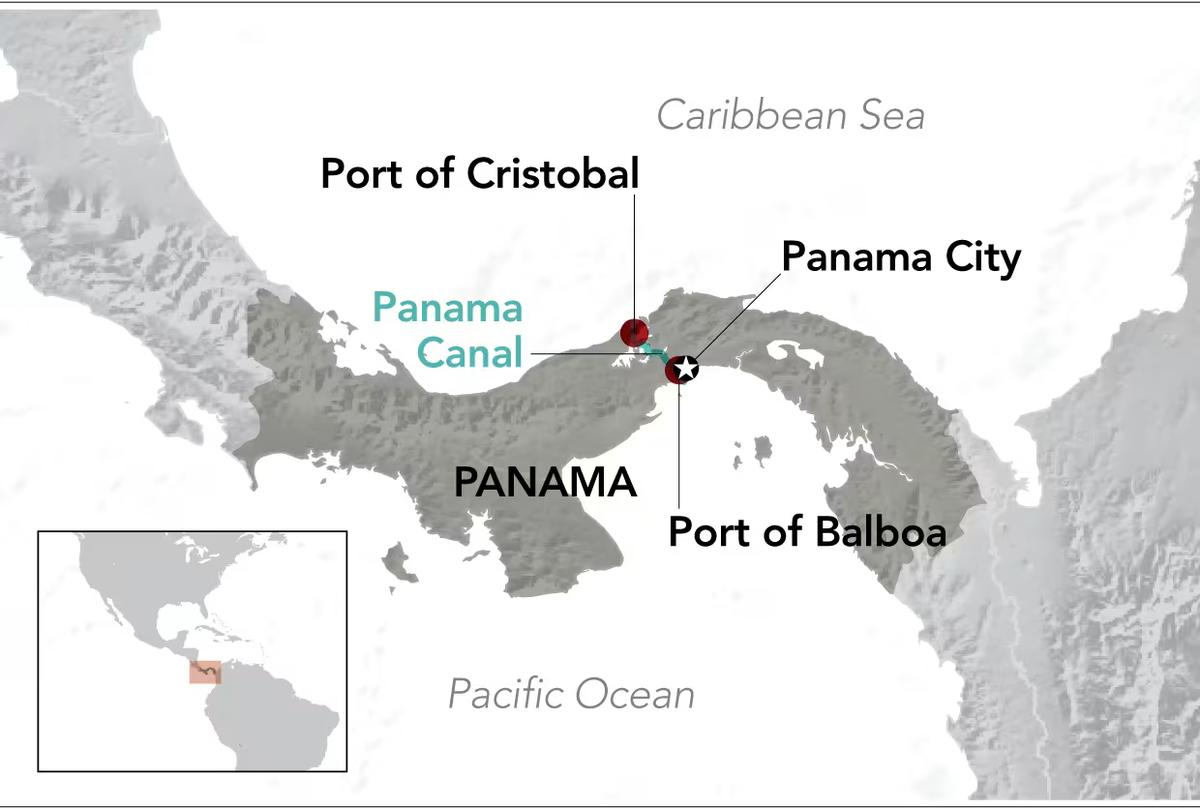

The divestment occurs amid intensifying geopolitical scrutiny, particularly concerning Chinese-affiliated entities managing critical global trade infrastructure. CK Hutchison’s presence at the Panama Canal had attracted attention from U.S. authorities, reflecting broader geopolitical sensitivities. By strategically exiting the ports sector, Li Ka-shing not only mitigates potential regulatory risks but also secures substantial liquidity, positioning the company to pivot towards less contentious, high-potential sectors.

Financial Resilience and Market Adaptation

This transaction infuses CK Hutchison with over $19 billion in capital, fortifying its balance sheet and unlocking new avenues for growth. The market's positive response, evidenced by a stock surge post-announcement, underscores investor confidence in this strategic realignment. Simultaneously, BlackRock’s acquisition highlights the increasing role of private equity in global infrastructure, as institutional investors seek stable, long-term assets amidst market volatility.

Evolving the Li Ka-shing Legacy

Known for his prescient investment strategies, Li Ka-shing has consistently adapted his business empire to align with shifting global trends. This divestment mirrors his historical pattern of exiting mature industries to pursue high-growth sectors. With CK Hutchison’s strengthened financial position, the company is well-equipped to accelerate investments in transformative areas such as digital infrastructure, artificial intelligence, and biotechnology.

Reshaping Global Trade Dynamics

This transaction also reflects broader shifts in global trade and investment patterns. The transfer of port assets to a U.S.-backed consortium exemplifies a redirection of capital flows, illustrating the evolving landscape where Western investment giants increasingly influence critical infrastructure ownership. This shift not only reduces geopolitical friction but also redefines strategic control in global trade routes.

Future Pathways for CK Hutchison

Post-sale, CK Hutchison stands at the cusp of a new era, with substantial capital to deploy into next-generation industries. This strategic liquidity offers the agility to explore innovative markets and sustain long-term growth. For Li Ka-shing, this deal reaffirms his status as a master strategist, whose sharp business acumen continues to shape global market dynamics well into his tenth decade.

At Sapio Insights, we view this divestment as a testament to Li Ka-shing’s strategic brilliance—a move that not only safeguards CK Hutchison’s future but also exemplifies adaptive leadership in an ever-evolving global economy.