We look at what Latin America offers investors, how to invest, and where the potential opportunities are?

1. Why Latin America?

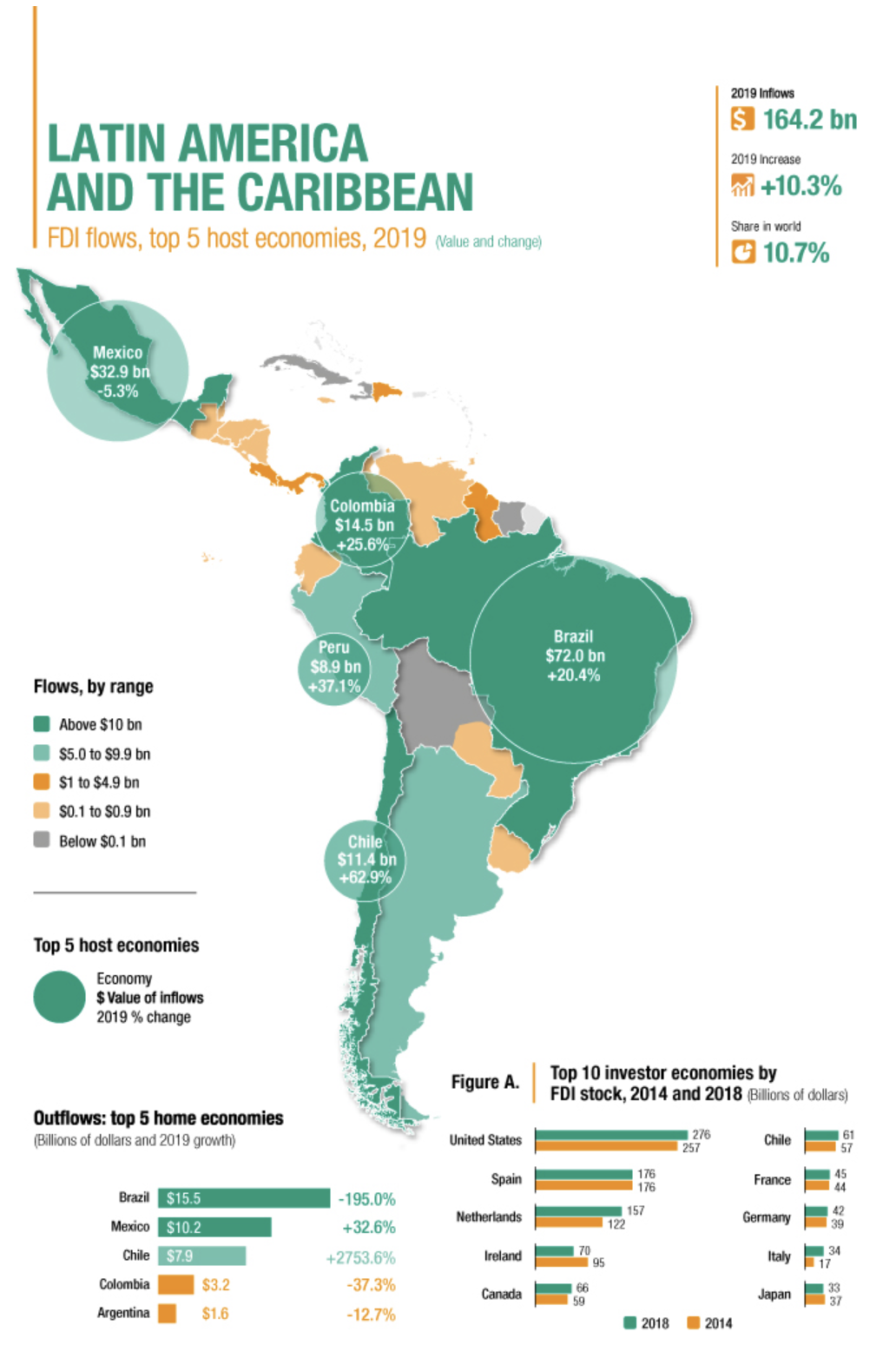

Latin America is gaining momentum as a key destination for investors in emerging markets, offering exciting opportunities for those seeking growth and diversification. With a population of nearly 670 million and a wealth of natural resources, the region’s diverse economies continue to attract global attention.

Politics often take center stage in Latin America, and 2024 has proven to be an eventful year. Six countries held presidential elections, with El Salvador, Panama, the Dominican Republic, and Mexico already announcing their results. Venezuela and Uruguay are set to follow later in the year.

Mexico, in particular, captured headlines with its historic 66th presidential election. Claudia Sheinbaum secured a landmark victory as the country’s first female president. While her decisive win introduced some market volatility — with stock prices dipping and the peso under pressure — it also opens the door for bold policy changes that could reshape Mexico’s economic landscape. Investors are watching closely for new opportunities amid the shifting environment.

As always, investing in Latin America comes with a higher degree of risk compared to other markets, largely due to its political and economic volatility. However, for those willing to navigate the ups and downs, the region continues to present dynamic opportunities for growth. Remember, all investments can rise and fall in value, and past performance isn’t a guide to future returns. If you’re unsure whether an investment is right for you, seek professional financial advice.

2. What are you investing in?

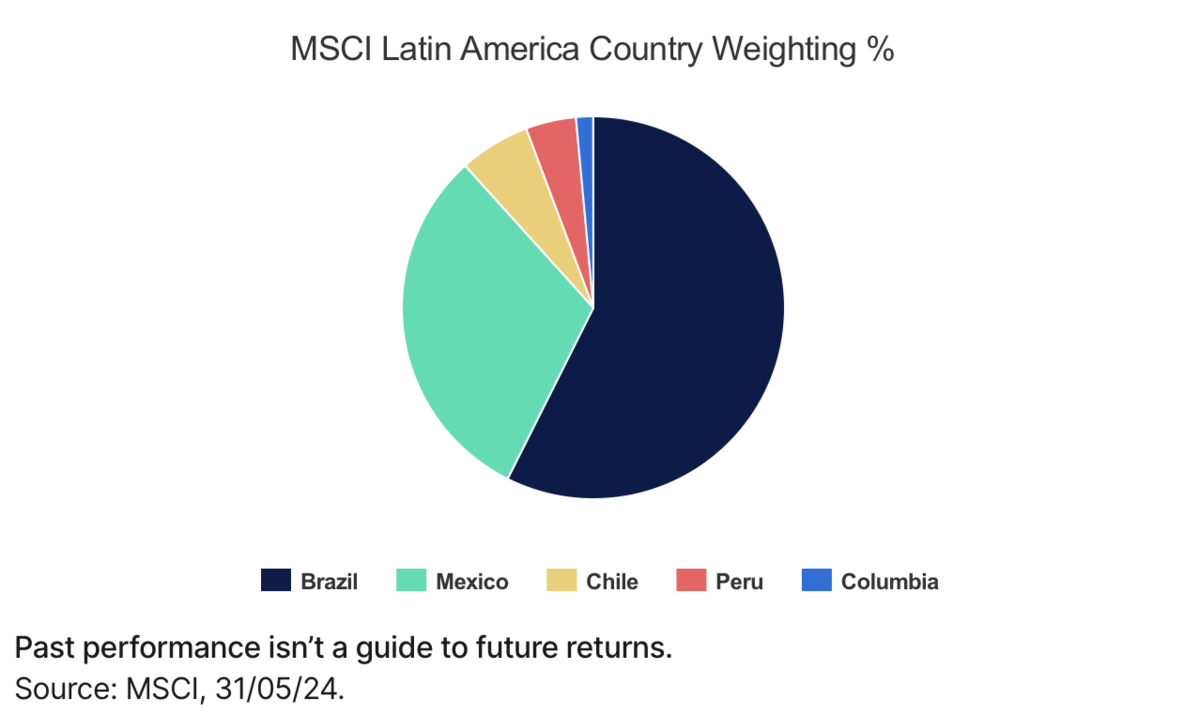

When considering investments, Latin America may represent a smaller portion of the global market, accounting for less than 1% of the MSCI AC World Index. However, it holds a larger stake in the emerging markets index, around 8%. Within the region, Brazil dominates with 57.41% of the MSCI Latin American Index's value, followed by Mexico at 30.91%. Smaller markets like Chile, Peru, and Colombia round out the index, though they are considerably smaller in comparison.

At the sector level, financial companies lead the charge, comprising about a quarter of the market’s value, followed by materials, consumer staples, and energy. Interestingly, the technology sector is underrepresented in Latin America, making up less than 1% of the index compared to 23% in the broader emerging markets index — presenting an opportunity for growth.

The Latin American Index is highly concentrated, with the top 10 companies accounting for 42.38% of its value, compared to 32.27% in the US market. This concentrated nature offers both risks and potential rewards for savvy investors looking to tap into the region's dynamic opportunities.

3. How has Latin America performe

Latin America's stock markets have delivered strong long-term returns. Over the past two decades, the MSCI EM Latin America Index has surged by 549.50%, outpacing the MSCI Emerging Markets Index's 466.19% and closely matching the MSCI AC World Index's 563.14%. However, the past decade has seen more modest gains, with the Latin American index returning 41.62% compared to 71.35% for the broader emerging markets.

Economic growth in the region has been sluggish, worsened by the pandemic. Despite this, Latin American markets remain attractive from a valuation perspective. Typically considered "cheap" compared to both their historical performance and developed markets, they are among the most affordable within global emerging markets.

Beyond capital appreciation, Latin America offers compelling dividend income. The Latin American Index yields 5.88%, well above the 2.75% yield of the MSCI Emerging Markets Index and the 1.96% yield of the MSCI AC World Index. However, it’s important to note that yields can fluctuate, and no investment guarantees future returns.

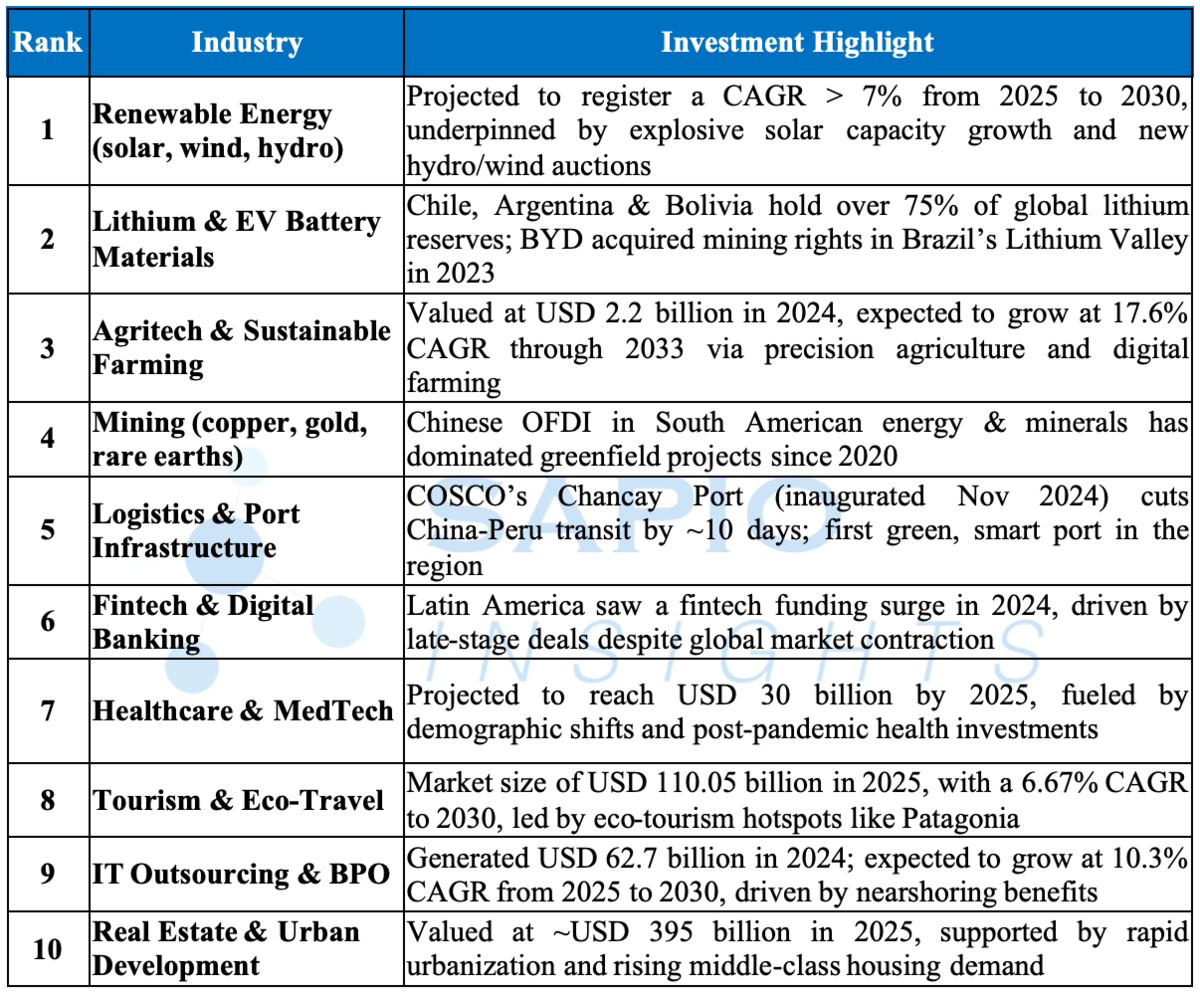

4. Top 10 Investment Opportunities in Latin America for Chinese Companies (2025)

5. Key Investment Strategies for Chinese Companies

- Leverage Multilateral Financing & Local Incentives

Utilize the Silk Road Fund, AIIB, and regional green funds while tapping into host‑government subsidies (e.g., Argentina’s lithium electricity price incentives) to lower capital costs and secure favorable terms - Export Proven Technologies & EPC Expertise

Deploy Chinese strengths in PV, wind turbine manufacturing, battery storage, digital payments, and AI‑enabled telemedicine to deliver turnkey projects that meet local performance and financing expectations - Forge Local Partnerships & Joint Ventures

Align with government‑backed entities (e.g., COSCO SHIPPING for port developments), national champions, and leading agribusiness or healthcare groups to navigate regulations, accelerate permitting, and access distribution channels - Mitigate Political, Environmental & Social Risks

Incorporate robust ESG frameworks, community engagement plans, and environmental impact assessments to address concerns raised by locals—such as those at Chancay Port—and maintain social license to operate - Build ‘China‑Plus‑Quality’ Brand Equity

Emphasize sustainability credentials in tourism and real estate (eco‑resorts, green buildings), and showcase long‑term service packages to differentiate Chinese offerings in competitive urban development and hospitality markets

At Sapio Insights, we believe Latin America is poised to deliver outsized returns in 2025 for investors who know where—and how—to look. By focusing on market‑leaders like Brazil and Mexico, under‑penetrated sectors such as technology and renewables, and leveraging local incentives with our proven multilateral financing playbook, you can position your portfolio for both growth and income.

Our dedicated team of emerging‑markets specialists combines on‑the‑ground intelligence, rigorous valuation analysis and tailored risk frameworks to help you:

- Identify the region’s next growth hotspots before they hit mainstream channels

- Structure investments to maximize dividend yields and capital upside

- Navigate political shifts and social‑license requirements with confidence

If you have any related inquiries, feel free to contact us

-WhatsApp:+852 93187597

-WeChat: SAPIOINSIGHTSHK

-Global Hotline: 400-9678-176

Scan the QR code for a free consultation: