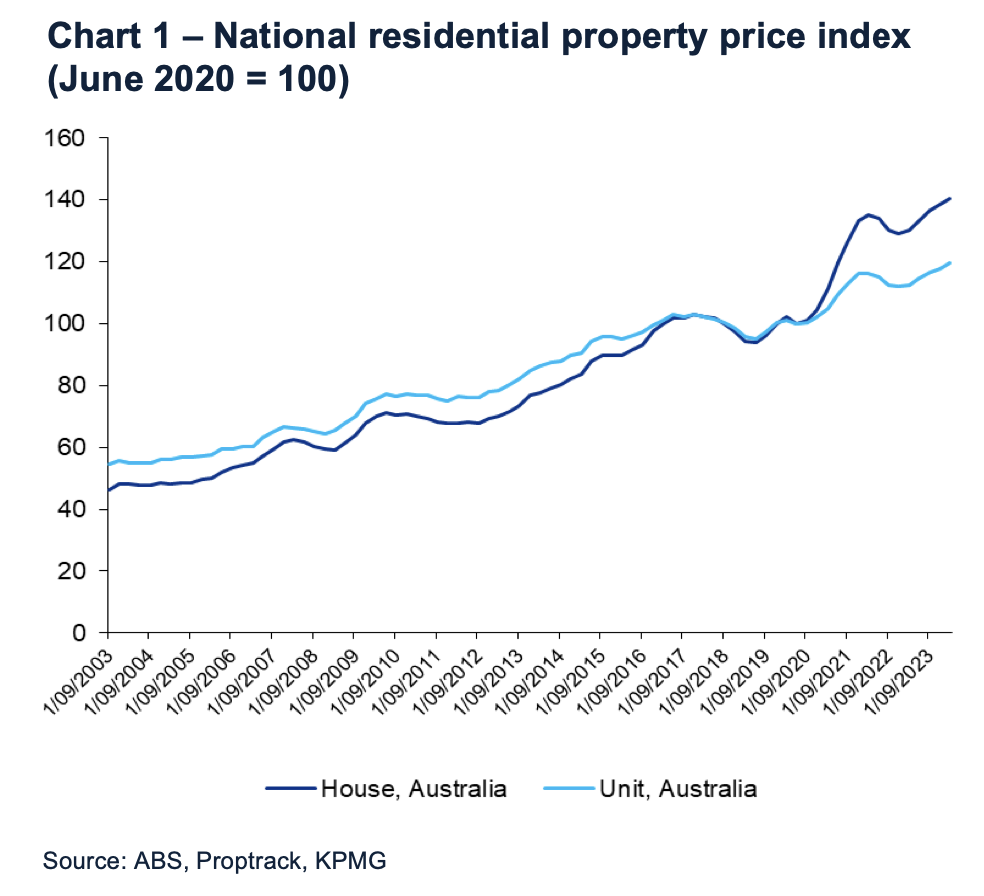

The Australian property market is expected to undergo significant changes in 2025, influenced by a range of economic factors, population growth, and shifting buyer preferences. Whether you're a first-time buyer, an experienced investor, or simply interested in market developments, understanding these key dynamics is essential for making informed decisions.

Future Housing Price Predictions: Steady Growth with Significant Regional Differences

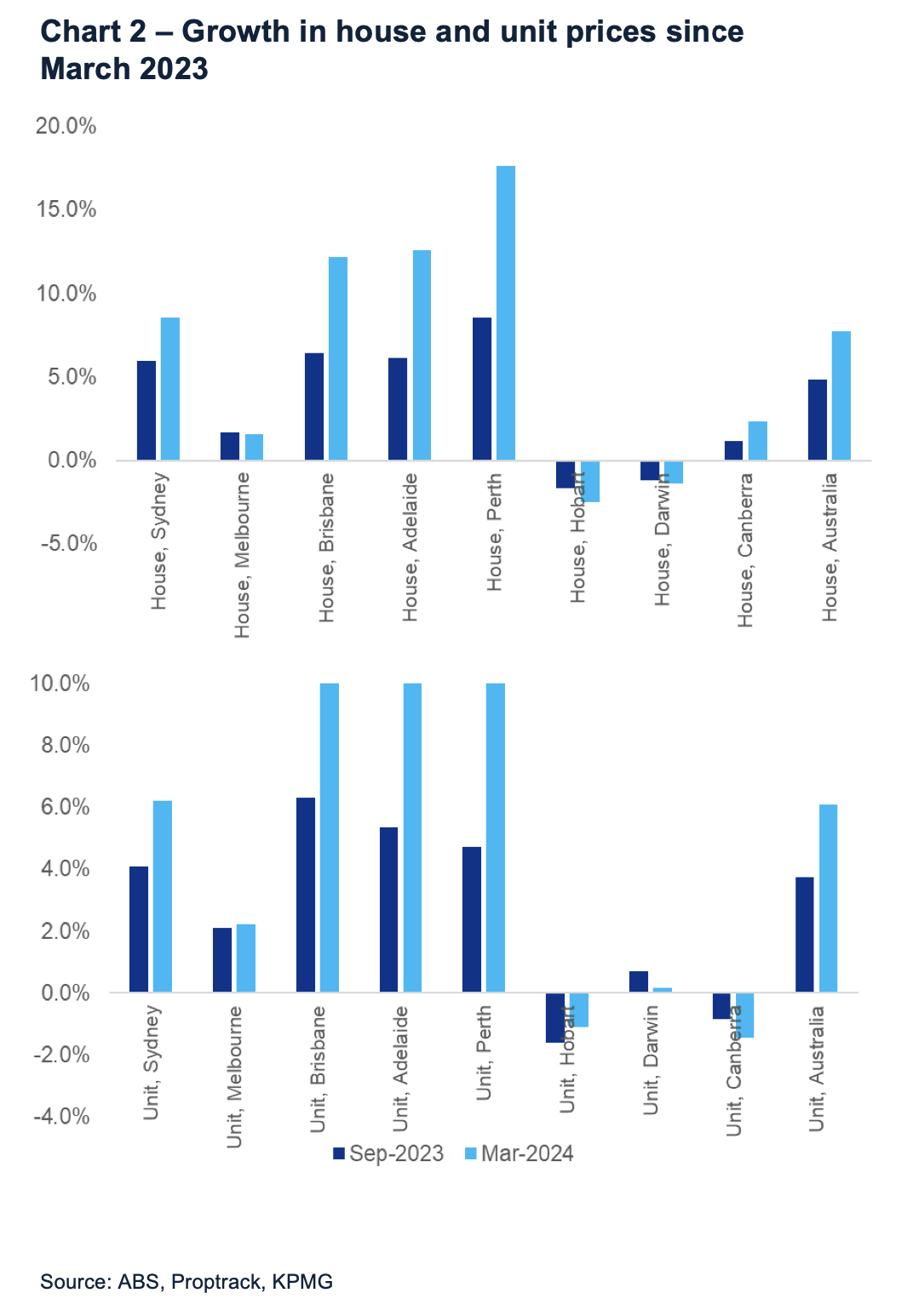

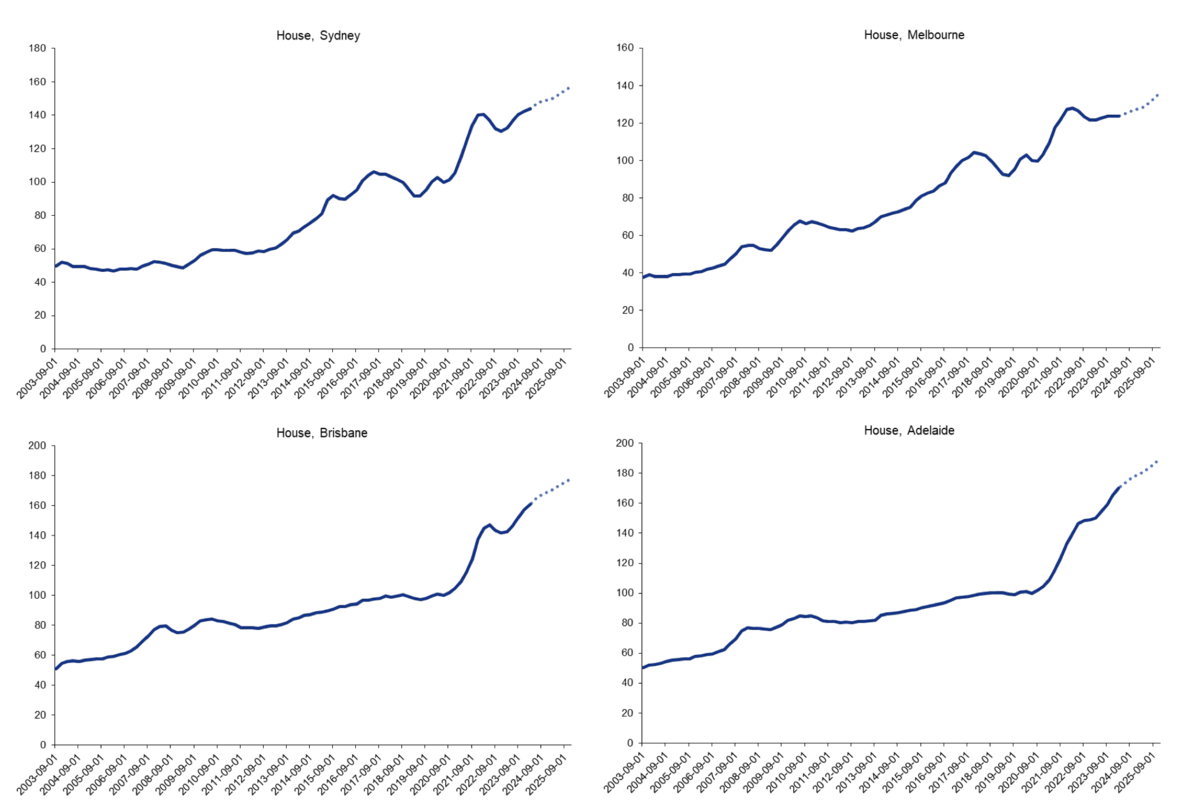

- Sydney & Melbourne: In Sydney, house prices are expected to increase by 6% to 8%, with the median price expected to exceed $1.7 million by mid-2025. Melbourne will see slower price growth, with an anticipated increase of up to 2%, bringing the median price to between $1.03 million and $1.05 million.

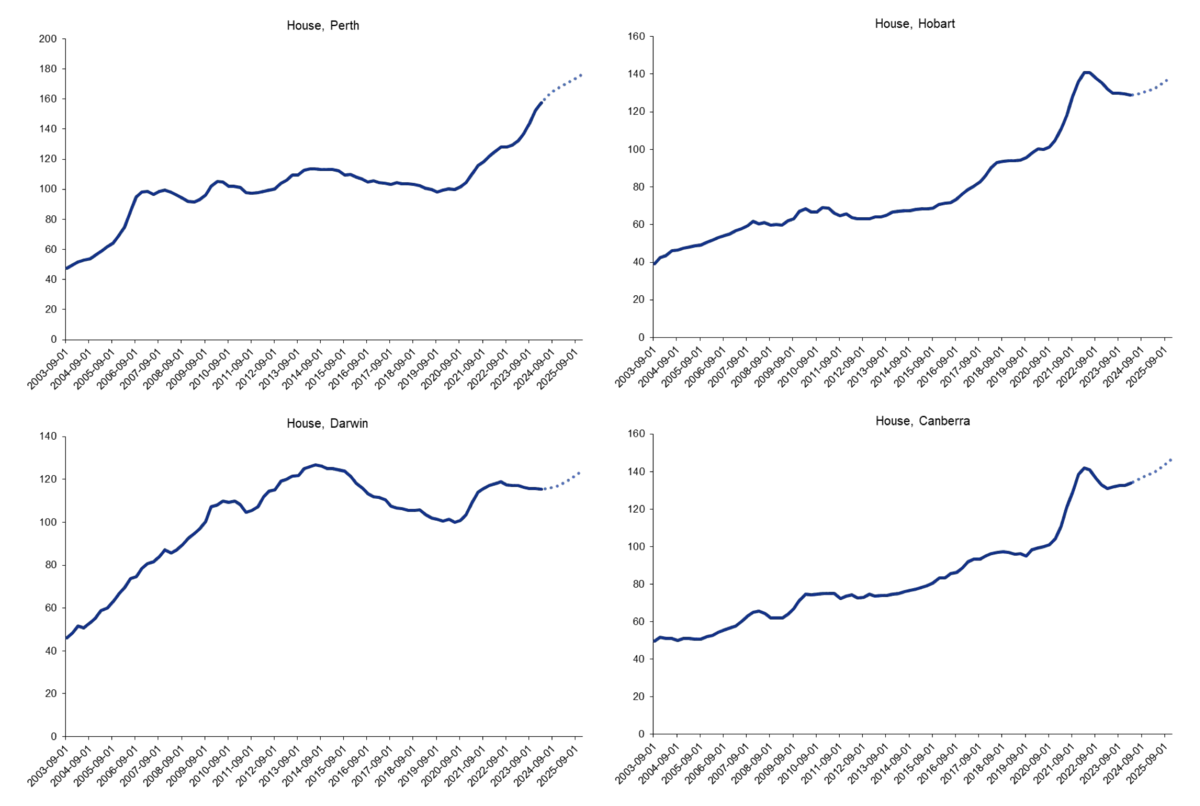

- Brisbane & Perth: Brisbane’s property prices are forecast to grow between 6% and 8%, with the median price approaching $810,000. Perth is expected to perform strongly, with prices rising by 8% to 10%.

- Regional Areas: Regional centres such as the Gold Coast and Sunshine Coast are also likely to see price increases, driven by their lifestyle appeal and relatively lower cost of living.

Market Drivers and Fundamentals

Several key factors will shape the market in 2025:

1、Economic Indicators: Strong GDP growth, low unemployment, and steady wage growth are expected to support buyer confidence and housing demand.

2、Supply and Demand: The imbalance between housing supply and demand will continue to push prices higher, particularly in urban areas where land availability is limited and demand is strong.

3、Interest Rates: Interest rates will be a critical factor. Lower borrowing costs could stimulate demand, further driving price increases.

Additional Insights

Despite an increase in investor demand, some economists predict that property price growth may slow in 2025. Data from the Australian Bureau of Statistics (ABS) shows that new investor loans increased by 1.4% to $11.7 billion in October 2024, approaching the peak levels seen in early 2022. Similarly, the total value of new housing loans rose by 1.0% to $30.4 billion.

Maree Kilroy, Senior Economist at Oxford Economics Australia, suggests that the market may weaken in the coming months. Several major cities, including Melbourne, Canberra, Hobart, and Darwin, recorded declines in property values in the September 2024 quarter.

Kilroy also pointed out that affordability challenges are pushing buyers toward lower-priced properties, with lower-price segments performing better than higher-end markets. This trend is most evident in mid-tier cities and lower-priced property markets.

Forecast of Housing Prices in Australia's Key Cities

Advice for Buyers and Investors

1、Do Your Research: Stay informed about market trends and economic indicators to make strategic investment decisions.

2、Look Beyond Major Cities: Regional markets often provide opportunities for growth and tend to be more affordable compared to larger cities.

3、Monitor Interest Rates and Policies: Changes in interest rates and government policies can significantly impact the property market, so keep an eye on these developments.

4、Seek Expert Guidance: Consult with financial professionals to tailor your investment strategy to your specific goals and needs.

Risks of Investing in Regional Areas

While regional markets can offer strong investment opportunities, there are risks to consider:

- Market Volatility: Property prices in regional areas may fluctuate more due to local economic conditions, employment rates, and population changes.

- Economic Dependency: Many regional areas are heavily reliant on industries such as mining, agriculture, or tourism. A downturn in these sectors can affect property values and rental demand.

- Infrastructure Challenges: Compared to urban areas, regional markets may have less developed infrastructure, which could impact property values and the appeal of these areas to potential buyers.

- Lower Demand: Regional markets tend to have lower property demand, which may lead to longer vacancy periods and slower capital growth, affecting rental yields and overall investment returns.

- Limited Access to Services: Regional areas may have fewer essential services like healthcare, education, and public transport, which can make properties in these areas less attractive.

- Natural Disasters: Certain regional locations are more vulnerable to natural disasters, such as floods, fires, or cyclones, which could impact property values.

- Financing Difficulties: Securing financing in regional areas can sometimes be more challenging, as lenders may view these investments as riskier and offer less favourable loan terms.

- Resale Value: Selling properties in regional markets may take longer and may not fetch as high a price compared to similar properties in metropolitan areas, which can affect your ability to sell the property quickly if needed.

Despite these risks, regional areas can still offer strong investment potential, especially when you conduct thorough research and focus on locations with growth prospects and diversified economies.

The Australian property market in 2025 presents a mix of opportunities and challenges. By staying informed and making strategic plans, buyers and investors can navigate this evolving landscape effectively. For personalized advice and further insights, feel free to reach out to our team. We are here to assist you in making the best decisions for your financial future.

Contact us

-WhatsApp:+852 93187597

-WeChat: SAPIOINSIGHTSHK

-Global Hotline: 400-9678-176

QR Codes: